Intel CEO: Taiwan’s Place in Tech Industry Is ‘Precarious’

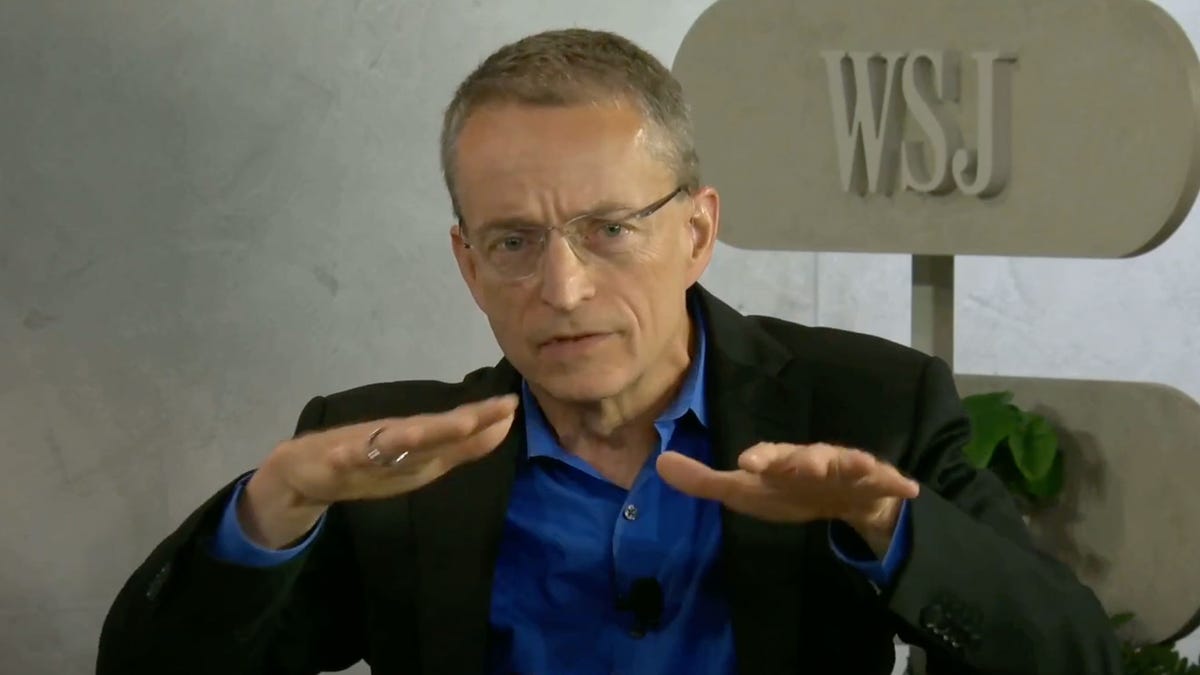

Intel CEO Pat Gelsinger speaks at the WSJ Tech Live conference.

WSJ Tech Live; Screenshot by Stephen Shankland/CNET

Taiwan is in a “precarious” position in the technology industry, Intel Chief Executive Pat Gelsigner said Monday as part of his company’s continuing push for more geographic diversity in electronics manufacturing.

“Taiwan plays such a critical role for the technology supply chains, but it’s precarious,” Gelsinger said Monday at the WSJ Tech Live conference. “The world needs geographically balanced, resilient supply chains.”

His remarks reflect new worries about whether China will try to reclaim Taiwan as its own territory. China conducted naval military exercises near Taiwan when US House Speaker Nancy Pelosi visited the island nation earlier this year, and Russia’s invasion of Ukraine has foreign policy experts reassessing their assumptions about geopolitics.

Taiwan is home to Taiwan Semiconductor Manufacturing Co. (TSMC), the global leader in the semiconductor industry. It makes processors for tech giants including Apple, Nvidia, Qualcomm, AMD, Tesla and even Intel itself. But Taiwan is headquarters to plenty of other big players, including PC makers Acer and Asus, TSMC chipmaking rival United Microelectronics, and Hon Hai Precision Industry Co., better known as Foxconn, which assembles iPhones at Chinese facilities.

Intel, of course, stands to benefit from any shift in chip manufacturing away from Taiwan. It’s pledged to build chips for other companies, not just itself. To meet expected demand, Intel is building new chip fabrication plants, called fabs, in Ohio, Arizona and Germany. That chip “foundry” effort is new to Intel, but it’s the core business for TSMC and Intel’s other top rival, Samsung in South Korea.

Intel also relies on TSMC, though. The company builds graphics chips for Intel’s Arc line of graphics processors, elements of Intel’s Ponte Vecchio processors that are the brains of the US government’s Aurora supercomputer, and will build parts of next year’s PC processors code-named Meteor Lake.

Taiwan’s independence from China has come under greater scrutiny with Russia’s invasion of neighboring Ukraine, which helped undermine the assumption that economic fallout would deter countries from going to war. China detailed its stance toward Taiwan in August, acknowledging “protracted political confrontation” between China and Taiwan but concluding, “The sovereignty and territory of China have never been divided and will never be divided, and Taiwan’s status as part of China’s territory has never changed and will never be allowed to change.”

Processors have become an essential component in everything from cars and toys to dishwashers and weapons systems. A chip shortage triggered by the COVID pandemic revealed how reliant we all have become on processors and the ability of manufacturers and distributors to match demand. The shortage was severe: automakers had to shut down production lines and ship vehicles without electronic components.

One result of the problem was political will to boost chipmaking in the US through a five-year, $53 billion subsidy in the CHIPS and Science Act. Ultimately, Gelsinger hopes the US will increase its share of chipmaking from about 12% today to 30% by the end of the decade, and Europe could climb from less than 10% to 20%. Asia’s share would drop from about 80% to about 50%.

“These things are long term,” Gelsigner said. It took 30 years for today’s electronics supply chains to build around the South China Sea, and President Joe Biden signing a massive government aid package is only a first step in reversing the trend, he said. But he believes the process is now underway.

“Where the oil reserves are defined geopolitics for the last five decades,” Gelsinger said. “Where the fabs are for the next five decades is more important.”