Intel Announces $88 Billion Megafab to Keep Chipmaking in Europe

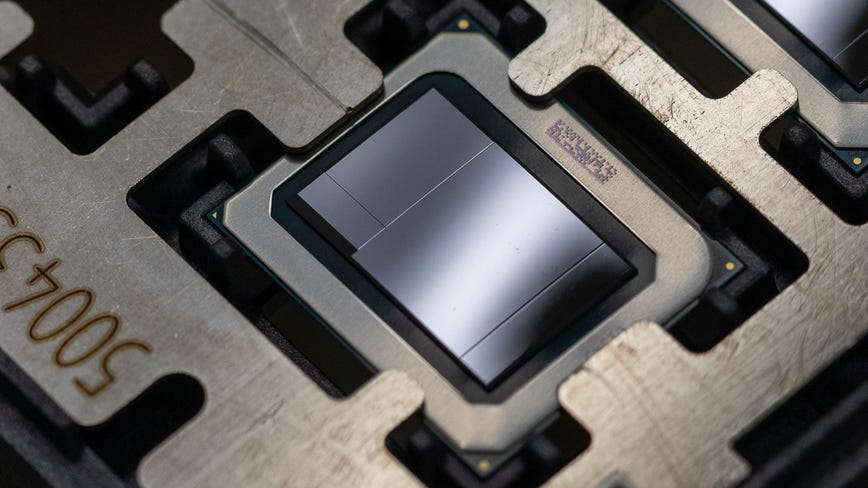

Intel’s Meteor Lake, shown here in a test form, is a PC chip due to ship in 2023.

Stephen Shankland/CNET

Intel on Tuesday revealed plans for a second new “megafab,” a chipmaking site in Magdeburg, Germany, that’s the centerpiece of an expected $88 billion in investments across several European countries. The capacity expansion comes on top of other gargantuan spending commitments in the United States, including a planned megafab in Ohio, intended to bring Intel back to the forefront of chip manufacturing.

“The world has an insatiable demand for semiconductors,” Intel Chief Executive Pat Gelsinger said in a video announcing the investments. Today, 80% of chipmaking takes place in Asia, but the company’s spending in the US and Europe will mean a “more balanced and resilient” supply chain that isn’t so dependent on Asia.

Intel will start with new chip fabrication facilities, called fabs, at the Magdeburg site costing about $19 billion, with construction set to begin in 2023 and manufacturing in 2027, Gelsinger said. That’ll let Intel build its own chips with leading edge technology, both for Intel itself and through a major expansion of its business called Intel Foundry Services, build chips for other customers as well.

Although the announcement centered on Europe, its success would help Intel in the United States. To stay on the leading edge of chip manufacturing, it’s essential to pay off extraordinarily expensive chipmaking equipment and facilities, so ramping up production is essential to reversing Intel’s slide out of chipmaking leadership.

Chipmaking Challenges

- Intel’s Chip Recovery Plan Could Restore US Manufacturing Prowess

- Intel Shows Off the Chip Tech That Will Power Your PC in 2025

- Biden to Congress: Pass Bill to Fund US Chip Manufacturing

Intel scattered its largesse across the continent. It’ll spend $13 billion to expand its existing fab in Leixlip, Ireland, doubling its size so the company can build chips on its new Intel 4 manufacturing process. Plateau de Saclay, France, will house a 1,000-employee research center. Intel also will expand its research site in Gdansk, Poland, add a new supercomputing research facility in Barcelona, Spain, and is negotiating on a plan expected to bring Intel’s advanced chip packaging technology to Italy.

Intel CEO Pat Gelsinger announces an 80 billion euro plan to invest in chip manufacturing and research in Europe.

Intel; Screenshot by Stephen Shankland/CNET

European Commission President Ursula von der Leyen lauded the investments as important to Europe’s high-tech future. “Our goal is to have 20% of the world’s microchip production in Europe by 2030. That’s twice as much as today in a market that’s set to double in the next decade,” she said on the video.

Intel expects the Magdeburg fabs will employ 7,000 people during construction and create 3,000 jobs once in operation.

Intel announced in 2021 that it would add the new production capacity in the United States and Europe, as part of a plan to rebalance chip manufacturing that’s moved mostly to Taiwan Semiconductor Manufacturing Co. (TSMC) in Taiwan and Samsung in South Korea. In February, Intel announced it’ll build two new fabs in Ohio for $20 billion, with construction set to start this summer, and an eventual expansion planned for a total of eight fabs through a $100 billion investment.

Although Intel is starting relatively small, with two fabs in Ohio and two more in Germany, it plans expansions over the course of the next decade. A modern fab these days costs around $10 billion, chiefly because of the hulking and extraordinarily expensive “lithography” machines needed to etch ultrasmall electronics onto silicon wafers.

Intel?

Miniaturizing those electronic elements, called transistors, has become harder and harder. That’s made chipmaking equipment more expensive. For Intel to keep a place at the forefront of semiconductor manufacturing — and for the US chipmaking industry to maintain its importance — Intel needs to build as many chips as possible to pay off enormous capital investments that have soured some financial analysts on Intel’s stock.

Happily for Intel, it has some tailwinds propelling it. First is strong demand thanks to a global chip shortage that continues to hold back supplies of everything from cars to consumer electronics. Second is new political will to subsidize US and European chip manufacturing, spurred by worry that Western economies and militaries will rely on Taiwanese and Korean manufacturing.

That legislation hasn’t passed, but if it does, it could knock about $3 billion off the price tag of each $10 billion fab and thereby speed up Intel’s capacity expansion. President Joe Biden in March exhorted lawmakers to pass their bills, just weeks after hosting Gelsinger’s Ohio megafab announcement at the White House.